So, you’re thinking about making the jump into a Mercedes-Benz electric vehicle—maybe the sleek EQS Sedan, the versatile EQB SUV, or something new in the pipeline. But before you plug in and hit the road, let’s talk about one of the most satisfying parts of going electric:

The EV tax credit. It’s like getting rewarded for being both eco-conscious and style-savvy. But the truth is, the world of tax credits for Mercedes-Benz EQ models isn’t just plug-and-play. There are eligibility criteria, evolving legislation, and a few surprises along the way.

Eligibility Criteria For EV Tax Credits

First things first—let’s talk federal. The Federal EV Tax Credit offers up to $7,500 off your tax bill if you buy a qualified clean vehicle. But not every electric model qualifies. The rules now consider where the car is assembled, where battery components come from, and even where the minerals are sourced.

And here’s the kicker: the vehicle needs to be new, have a price under certain caps (around $80,000 for SUVs), and you—the buyer—must meet income limits. These rules evolved after the Inflation Reduction Act, so what worked in 2023 may not apply now in 2025.

Specific Requirements For Mercedes EQ Models

So where does that leave our beloved Mercedes-Benz EV models? Well, some do qualify, some don’t—at least not for the full credit. For example, the U.S.-assembled EQB SUV may qualify for partial credit depending on the trim and final assembly location. Meanwhile, the German-made EQS Sedan typically doesn’t qualify for federal incentives, though it still shines with national offers and dealer finance specials.

The best way to check? Head to the dealership’s finance center or use IRS tools to confirm current qualification status by Mercedes-Benz model and VIN.

Differentiating Between EVs And PHEVs

This is where things get tricky. Not all electric vehicles are fully electric. Some are PHEVs (plug-in hybrid electric vehicles). That matters. PHEVs like the upcoming 2025 GLC Plug-in Hybrid can qualify for reduced federal tax credits—based on battery size and electric-only range.

So while a hybrid electric vehicle might not be as “clean” as a full EV, it can still put some cash back in your pocket if it meets IRS benchmarks.

Available Tax Credits For Mercedes EQ Models

List of Eligible Mercedes EQ Models

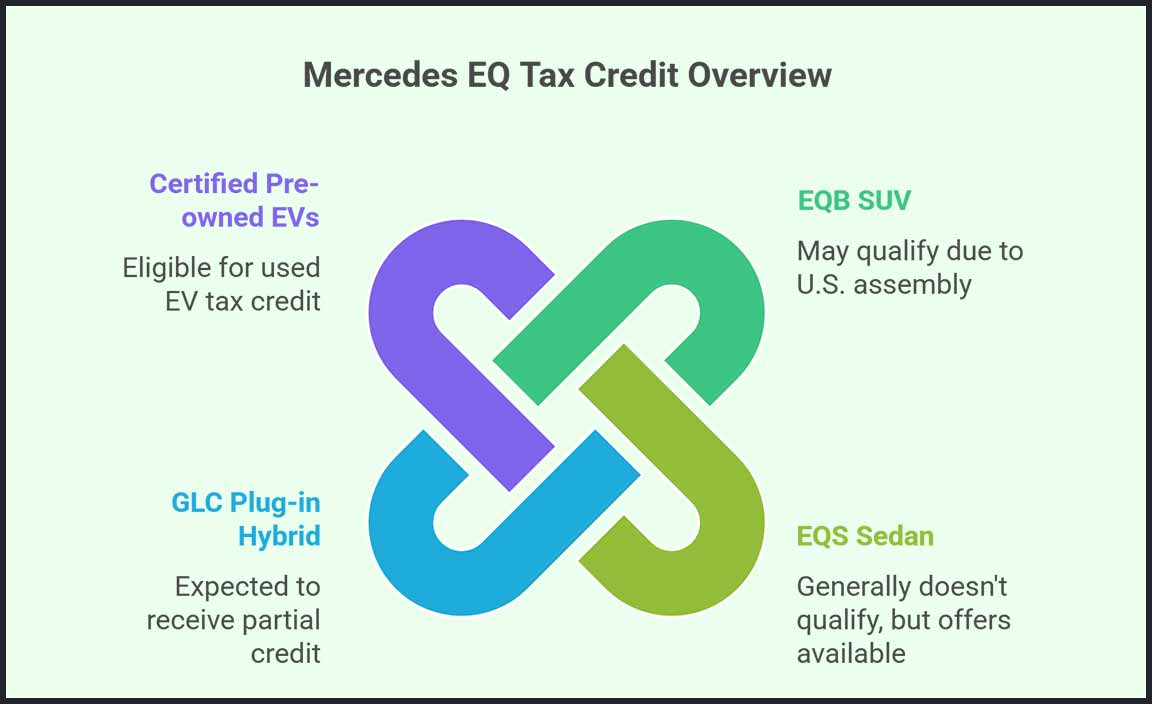

As of June 2025, here’s a quick look at how Mercedes-Benz EQ models align with tax credits:

EQB SUV: May qualify (assembled in the U.S. in some cases)

EQS Sedan: Generally doesn’t qualify for federal, but special offers often available

GLC Plug-in Hybrid (new model): Expected to receive partial credit

Certified pre-owned Mercedes-Benz EV models: Eligible for used EV tax credit (details below)

Keep in mind that vehicle specials may apply regardless of federal incentives. You can often find shopping tools, finance specials, and lease return deals to stack savings.

Insights On The Mercedes-Benz EQ Lineup

The Mercedes EQ vehicle lineup is growing fast. From the flagship EQS Sedan with its hyper-luxury interior to the family-ready EQB SUV, there’s an electric car for nearly every lifestyle. These vehicles feature cutting-edge EQ Technology, built-in DC fast charging support, and tech-heavy dashboards that feel straight out of 2030.

And yes, even if a model doesn’t qualify for a tax credit, it’s hard to ignore the value of driving a luxury electric vehicle that blends performance, Mercedes-Benz S-Class comfort, and futuristic design.

How To Claim The Federal Tax Credit

Steps to Applying for the Tax Credit

If you’re buying an eligible new Mercedes-Benz EV, claiming the EV tax credit is pretty straightforward:

Confirm vehicle eligibility: Verify the model and trim qualify on the IRS website.

File IRS Form 8936: You’ll need this form when doing your taxes.

Use your Payment Calculator: Work with the finance center to estimate post-credit pricing.

Retain documents: Purchase agreement, VIN, and dealership verification of tax credit eligibility.

Just remember: this is a tax credit, not a rebate. It reduces your owed federal tax—not the vehicle’s sticker price.

Required Documentation And Forms

In most cases, you’ll need:

IRS Form 8936 (Qualified Plug-In Electric Drive Motor Vehicle Credit)

Purchase agreement with VIN

Dealership’s documentation showing Mercedes-Benz qualify status for the selected model

If the vehicle qualifies, your tax return will reflect the full or partial credit as a deduction on what you owe Uncle Sam.

Understanding Pre-Owned EV Tax Credits

Federal Pre-Owned EV Tax Credit Overview

Buying used? There’s still good news. A federal pre-owned EV tax credit of up to $4,000 is now available. This applies to certified pre-owned vehicles or even pre-owned specials under $25,000—great news if you’re eyeing a slightly older EQ model.

But again, you must buy from a licensed dealer, and the vehicle must be at least two model years old.

Criteria For Pre-Owned Mercedes EQ Models

To qualify for the used EV credit, the pre-owned Mercedes-Benz must:

Be from the Mercedes-Benz EQ family (like a 2022 EQB or EQS)

Be priced under $25,000

Not have been sold as a credit-claimed vehicle before

Be used by the buyer (not resold immediately)

Certified dealerships like Autonation Inc often stock qualifying models, and they’ll help you navigate the finance application and related paperwork.

Maximizing Tax Credit Benefits

Leveraging Dealer Advice and Resources

Dealers are your secret weapon here. Many Mercedes-Benz retailers offer shopping tools, calculators, and express service for quick inspections and EV evaluations. Ask about Mercedes-Benz Partner Programs that may offer additional savings or employer discounts.

Oh—and don’t skip the parts specials if you’re personalizing your new EQ ride.

Strategies For Maximizing Savings

Want to stack your savings? Try this:

Start with a new vehicle special or pre-owned vehicle special

Apply your tax credit at tax time

Use dealer finance specials to lower your APR

Explore national offers and Mercedes-Benz certified vehicles for extra perks

Even if the federal credit doesn’t fully apply, many EQ models are supported by state-level incentives and Electrify America charging promotions. Combined, these can make your first year of ownership surprisingly cost-effective.

Considerations For New EV Technologies

Innovations in 2025 GLC Plug-in Hybrid

The 2025 GLC Plug-in Hybrid is particularly exciting. It’s a hybrid electric vehicle that blends traditional gasoline power with an extended electric-only range—ideal if you’re transitioning from gas to electric. Plus, it’s expected to meet requirements for partial EV credits, making it a sweet middle ground.

It also features upgraded DC fast charging, real-time battery monitoring, and next-gen EQ Technology that rivals even full EVs in driving smoothness and power delivery.

Benefits Of Adopting New Technologies

Let’s be honest—early adopters get perks. Beyond the tax credit, you’re getting:

Lower maintenance vs. gas cars

Quiet, ultra-smooth rides

Access to priority parking and HOV lanes in many cities

Support from Mercedes-Benz’s expanding new inventory of service-friendly EVs

Plus, innovations in electric cars work best when adopted early—like over-the-air updates and smart charging networks.

Broader Context Of Qualified Clean Vehicle Tax Credits

Overview of Other Eligible Manufacturers and Models

Mercedes isn’t alone in the game. Other eligible electric vehicle makers include Ford (F-150 Lightning), Tesla (Model Y), and Rivian. However, few match the luxury and refinement of a Mercedes-Benz electric vehicle—especially in interior design and brand status.

So while others qualify, driving a Mercedes EQ vehicle is about more than credits. It’s about lifestyle, confidence, and long-term vision.

Insights From Dealership Locations

Whether you’re browsing in-person or online, dealership support is everything. The Mercedes-Benz Finance Center can:

Check current recall information

Confirm pre-owned vehicle specials

Help submit your finance application

Navigate new Mercedes-Benz inventory vs. certified pre-owned inventory

Some even offer lease return programs with flexible upgrade options—perfect if you’re planning to switch from gas to electric over time.

Final Thoughts

Here’s the truth: EV tax credits aren’t one-size-fits-all. But if you’re strategic, they can tip the scales in favor of a smarter, cleaner investment. Whether it’s a new Mercedes-Benz EV, a pre-owned Mercedes-Benz, or an upcoming hybrid electric vehicle, the key is knowing your options.

And when you pair all that tech and style with a little money back at tax time? That’s what I call a win.

FAQ

1.Do Mercedes EQ Models Qualify For The Federal EV Tax Credit?

Some Mercedes EQ models, like the U.S.-assembled EQB SUV, may qualify for federal EV tax credits. Others, such as the EQS Sedan, generally do not due to foreign assembly or component sourcing. Always verify eligibility through IRS tools or your dealership.

2.How Much Is The EV Tax Credit For Mercedes-Benz Electric Vehicles?

The federal tax credit can be up to $7,500 for new qualifying EVs and $4,000 for eligible used models. The final amount depends on factors like battery components, final assembly location, and buyer income limits.

3.Is There A Tax Credit For Used Mercedes-Benz Electric Vehicles?

Yes. A federal pre-owned EV tax credit of up to $4,000 is available for certified pre-owned Mercedes-Benz EQ models under $25,000 and at least two model years old. Buyers must meet income and purchase criteria.

4.How Do I Claim The EV Tax Credit For A Mercedes EQ Vehicle?

You’ll need to file IRS Form 8936 with your federal tax return. Documentation must include the purchase agreement, VIN, and dealer verification of the model’s eligibility. The credit is applied against the buyer’s tax liability.

5.Which Mercedes EQ Models Are Eligible In 2025?

Eligibility may include the EQB SUV and the upcoming 2025 GLC Plug-in Hybrid (if assembled domestically). Check with your Mercedes-Benz Finance Center or IRS database for current model eligibility based on final assembly and battery rules.