A company’s stock performance is a key indicator of its financial health and market position, influencing both short-term trading strategies and long-term investment decisions.

Understanding stock trends, market indices, interest rates, and corporate earnings helps investors assess risks and opportunities. Factors such as economic conditions, industry performance, and global events also play a crucial role in shaping stock prices. This article explores key market indicators, evaluates investor sentiment, and provides essential strategies to navigate market volatility effectively.

Key Takeaways

- Stock Performance Drivers – Corporate earnings, interest rates, and economic growth significantly impact stock valuations.

- Market Trends – Growth stocks like tech companies offer high returns, while value stocks provide stability.

- Investor Sentiment – Influenced by market news, economic indicators, and global events.

- Investment Strategies – Diversification, long-term planning, and expert guidance help navigate market volatility.

- Future Outlook – Interest rate policies, corporate earnings, and emerging markets will shape stock performance in 2025.

What Affects A Company’s Stock Performance?

A company’s stock performance is influenced by various economic, financial, and market factors. Investors analyze these elements to determine potential growth, risks, and market trends. Understanding these factors can help in making informed investment decisions.

- Corporate Earnings – Strong earnings growth often drives stock prices higher.

- Market Sentiment – Investor perception and confidence impact stock demand.

- Interest Rates – Higher rates can lower stock valuations as borrowing costs rise.

- Economic Growth – A robust economy supports corporate profitability and stock appreciation.

- Bond Yields – Rising yields can make fixed-income investments more attractive than stocks.

What Growth Stock Is Going To Boom In 2025?

Identifying growth stocks poised for significant appreciation in 2025 requires analyzing current market trends and company fundamentals. Companies like NVIDIA Corporation (NVDA), Amazon.com, Inc. (AMZN), and Alphabet Inc. (GOOGL) have been highlighted for their robust growth prospects, driven by advancements in artificial intelligence and cloud computing.

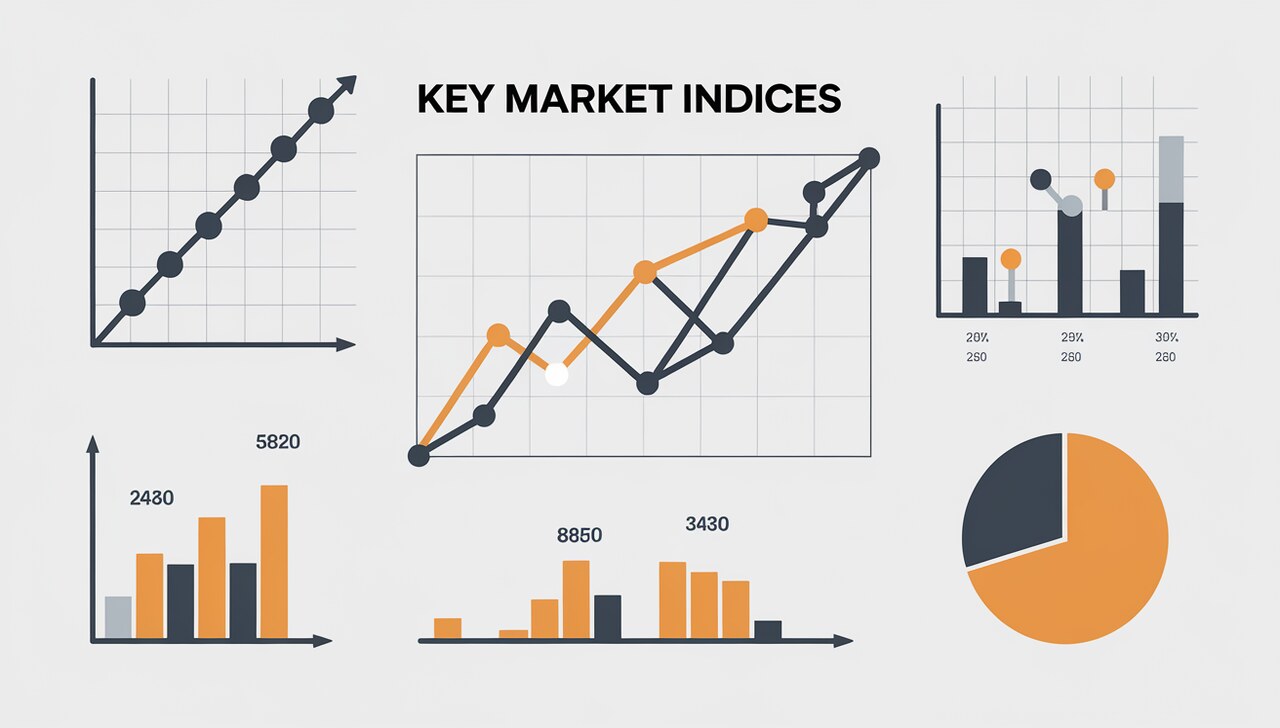

Key Market Indices & Their Influence

Tracking stock indices helps investors gauge the overall market performance. Here’s a look at the most influential ones:

| Index | Description | Impact on Market |

|---|---|---|

| S&P 500 Index | Measures 500 largest U.S. companies | Broad economic indicator |

| Dow Jones Industrial Average | Tracks 30 blue-chip U.S. stocks | Represents the industrial sector |

| London Stock Exchange (FTSE 100) | Tracks UK’s top 100 companies | Global equity insights |

| NASDAQ Composite | Tech-heavy index with high growth potential | Reflects tech stock trends |

Market Trends: Growth vs. Value Stocks

When investing in the stock market, understanding the difference between growth and value stocks is crucial. Both categories offer unique advantages depending on an investor’s financial goals, risk tolerance, and market conditions.

- Growth Stocks are companies expected to expand earnings at an above-average rate. They typically reinvest profits to fuel expansion rather than paying dividends. These stocks are commonly found in technology, e-commerce, and innovative industries. A prime example is the Magnificent 7 stocks, which include leading tech giants with high revenue growth potential.

- Value Stocks are established companies that trade at lower prices relative to their fundamentals, such as earnings and book value. These stocks often pay dividends, making them attractive for long-term stability and income generation. They are usually found in sectors like finance, consumer goods, and industrials.

Key Comparisons:

- Growth Stocks: High potential for future earnings, often in tech and emerging sectors.

- Value Stocks: Established companies with stable revenues, often undervalued by the market.

- Market Breadth: Measures how many stocks are moving up or down; stronger breadth suggests a healthier market.

Investor Sentiment & Market Behavior

Investor sentiment is a key driver of stock market movements, reflecting the collective mood and confidence of investors. It influences buying and selling decisions, impacting stock prices and market trends. Sentiment can be swayed by economic conditions, financial news, and global events.

A bullish sentiment leads to increased market participation, driving prices higher, while a bearish sentiment results in cautious trading and potential downturns. Understanding these behavioral trends helps investors make informed decisions and manage risk effectively.

Key Influences On Investor Sentiment:

- Economic Indicators: Consumer Price Index (CPI) and GDP growth impact investor confidence and spending power.

- Market Volatility: Higher uncertainty leads to rapid stock price fluctuations, affecting investment strategies.

- Bond Market Influence: Rising bond yields make fixed-income investments more attractive, reducing stock demand.

Investment Strategies For Long-Term Success

Building a successful long-term investment strategy requires balancing risk and return while staying adaptable to market conditions. Investors should focus on portfolio diversification, disciplined financial planning, and a clear understanding of economic trends.

The key to sustained growth lies in selecting the right mix of asset classes, considering personal risk tolerance, and leveraging expert financial advice. With global markets evolving, investors should be mindful of emerging opportunities in sectors like technology, private equity, and smaller companies. A forward-thinking approach ensures stability and growth, even during market fluctuations.

- Diversification: Reduce risk by spreading investments across stocks, bonds, mutual funds, and alternative assets.

- Wealth Management: Work with a financial advisor to create a strategy tailored to your financial goals.

- Private Equity & Alternatives: Higher returns are possible, but these require in-depth research and long-term commitment.

- Equity Outlook for 2025: Analysts anticipate steady global equity growth, with tech and small-cap stocks leading gains.

Future Market Predictions & Key Trends To Watch

As global financial markets continue to evolve, investors must stay informed about key economic drivers that influence stock performance. Factors such as central bank policies, corporate earnings reports, and shifts in emerging markets can significantly impact investment decisions.

Additionally, the rapid advancements in technology make tech stocks an attractive option, but they also introduce volatility. Keeping an eye on these crucial trends helps investors navigate market uncertainties and position their portfolios for long-term success.

Key Areas To Monitor:

- Central Bank Policies: Interest rate decisions by major banks shape stock market movements and investor sentiment.

- Corporate Earnings Reports: Quarterly financial results influence stock prices and overall market confidence.

- Emerging Markets: High-growth potential but accompanied by economic and geopolitical risks.

- Tech Stocks: Continued innovation and digital transformation drive investor interest despite market volatility.

Conclusion

A company’s stock performance is influenced by various economic, financial, and market-driven factors. Understanding these dynamics helps investors make informed decisions, manage risks, and seize opportunities. As 2025 unfolds, factors like interest rate policies, corporate earnings, and technological advancements will continue shaping market trends.

Investors should focus on a diversified strategy, balancing growth and value stocks while staying informed about global economic shifts. By keeping a close watch on key indicators and adapting to market conditions, investors can optimize their portfolios and position themselves for long-term success.

FAQs

1.What Factors Influence Stock Price Fluctuations?

Stock prices fluctuate due to several factors:

- Earnings Reports: Positive or negative earnings can significantly impact stock valuations.

- Economic Growth: A robust economy often leads to higher corporate profits, boosting stock prices.

- Interest Rate Changes: Rising interest rates can increase borrowing costs, potentially reducing corporate earnings and leading to lower stock prices.

- Investor Sentiment: Market perceptions and investor confidence can drive buying or selling trends, affecting stock prices.

2.How Do Interest Rates Impact Stock Market Performance?

Interest rates play a pivotal role in stock market dynamics. Higher interest rates can increase borrowing costs for companies, potentially reducing profitability and leading to lower stock prices. Conversely, lower interest rates can stimulate economic activity, potentially boosting corporate earnings and stock valuations.

3.What Are The Best Strategies For Long-Term Stock Investment?

Effective long-term investment strategies include:

- Diversification: Spreading investments across various asset classes to mitigate risk.

- Balanced Portfolio: Combining growth and value stocks to capitalize on different market conditions.

- Professional Guidance: Consulting financial advisors for personalized investment advice.

4.How Do Economic Indicators Like The Consumer Price Index (CPI) Affect Investor Outlook?

The Consumer Price Index (CPI) measures inflation by tracking changes in the price level of a basket of consumer goods and services. A rising CPI indicates increasing inflation, which can erode purchasing power and lead to higher interest rates, potentially dampening investor confidence and affecting stock market performance.

5.What Is The Role Of Private Equity In Financial Markets?

Private equity involves investing in companies not listed on public exchanges, providing capital for expansion, restructuring, or acquisitions. These investments offer opportunities for substantial returns but come with higher risks and longer investment horizons compared to public equities.

6.How Can Investors Manage Market Volatility Effectively?

Investors can navigate market volatility by:

- Diversifying Portfolios: Investing across various sectors and asset classes to spread risk.

- Maintaining a Long-Term Perspective: Focusing on long-term goals rather than short-term market fluctuations.

- Avoiding Emotional Decisions: Refraining from panic selling during market downturns to prevent locking in losses.

7.What Is The S&P 500 Index, And Why Is It Significant?

The S&P 500 Index comprises 500 leading publicly traded companies in the U.S., serving as a benchmark for overall stock market performance. It reflects the health of large-cap companies and is widely used to gauge the market’s direction.

8.Who Are The ‘Magnificent 7’ Stocks, And Why Are They Important?

The ‘Magnificent 7’ refers to seven major technology companies- Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla- that have significantly influenced market trends due to their substantial market capitalizations and growth trajectories.

9.What Is Earnings Growth, And How Does It Affect Stock Prices?

Earnings growth indicates an increase in a company’s profits over time. Consistent earnings growth often leads to higher stock prices, as it reflects a company’s financial health and potential for future expansion.

10.How Do Mutual Funds Assist Individual Investors?